Expert guide to trends and outlook for 2025

Un livre blanc de Vignobles & Compagnie

🌱 Introduction: a market in transformation

The French wine and spirits market is going through an unprecedented period of transformation. Far from being a simple cyclical evolution, we are witnessing a complete redefinition of consumption codes that are shaping the future of our terroirs and traditional know-how.

This transformation is part of a broader societal context, where French consumers are rethinking their relationship with alcohol, favoring quality over quantity and seeking authentic and sustainable experiences. The SOWINE/Dynata 2025 Barometer, an essential reference in the sector for 15 years, reveals trends that are reshaping the contours of our industry.

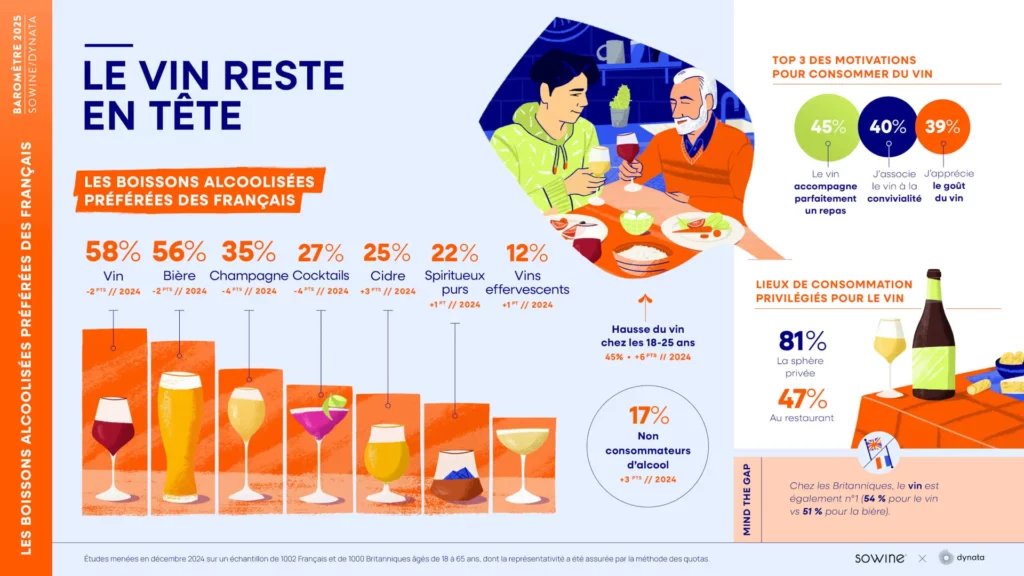

Key figures for 2025:

- 58% of French people place wine as their favorite alcoholic beverage (down 2 points)

- 17% of the population no longer consumes alcohol (up 3 points)

- 76% of consumers show curiosity towards viticultural innovations

- 34% of French people have practiced wine tourism in a wine region

This transformation does not mean the decline of our traditions, but rather their adaptation to the expectations of a society in search of meaning and authenticity. The producers who will be able to understand and support these evolutions will be those who will prosper in the years to come.

🍷 Chapter 1: new consumption habits

More thoughtful and segmented consumption

The year 2025 marks a turning point in French consumption habits. The general trend reveals a more conscious and selective approach, particularly visible among younger generations.

Evolution of preferences by segment:

Among 18-25 year-olds: This age group, often considered less interested in wine, surprises with its evolution. For the first time, wine becomes their favorite alcoholic beverage (45%, +6 points), even surpassing beer and cocktails traditionally favored. This generation also shows growing interest in cider (+7 points) and pure spirits (+4 points), demonstrating remarkable taste curiosity.

Differentiation by gender: Consumption dynamics reveal significant gaps between men and women. While male preference for wine intensifies (+3 points, reaching 67%), women are gradually turning away from it (-6 points, 50%). This evolution is accompanied by a notable progression of pure spirits among women (+3 points), a sign of taste diversification.

The rise of non-consumption

A particularly striking phenomenon is the increase in non-alcohol consumption, which reaches 17% of the population (+3 points). This trend, more pronounced among women (23%, +6 points), is part of a wellness and reasoned consumption approach.

This evolution should not be perceived as a threat, but as an opportunity for producers to rethink their marketing approaches and develop products adapted to these new expectations.

Redefined consumption moments

Consumption habits are also evolving in their temporality. Weekend evenings remain the preferred time (69%, +2 points), but we observe a redefinition of codes according to beverage types:

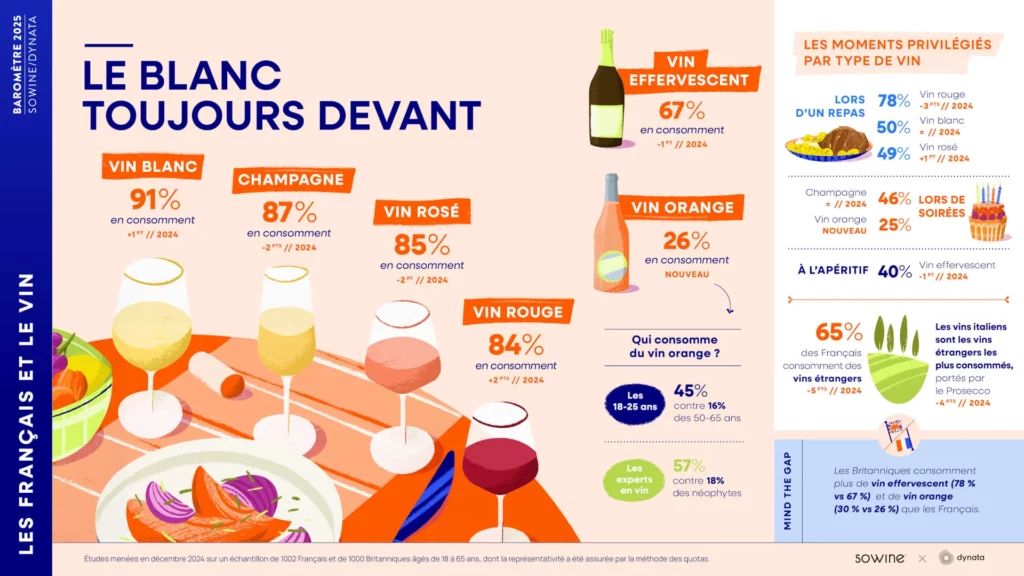

- Red wine: Remains associated with meals (78% of occasions)

- White and rosé wines: Conquering the aperitif (33% and 31% respectively)

- Sparkling wines: Dominating evenings and aperitifs (40% and 36%)

This temporal segmentation offers producers specific positioning opportunities according to consumption moments.

🐣 Chapter 2: new consumption habits

Analysis of declining consumption

The decline in wine consumption, confirmed by the Kantar Worldpanel study for CNIV, reveals complex patterns that require a nuanced approach. This trend does not uniformly affect all market segments.

Differentiated impacts by category:

Sparkling wines: Declining consumption mainly concerns aperitifs with guests among those over 50, but also meals among those under 50. This generational segmentation reveals evolving consumption codes.

White wines: The decline is mainly observed during aperitifs without guests among seniors, while younger generations maintain this habit. This generational dichotomy opens marketing repositioning perspectives.

Red wines: Pillars of daily consumption, they suffer erosion mainly linked to declining consumption among those over 50 during daily meals.

Substitution strategies

The analysis of substitute beverages reveals action paths for the wine industry. In 80% of cases, wine is replaced by non-alcoholic beverages, mainly water. This trend confirms the evolution towards more moderate consumption rather than wine rejection.

Repositioning opportunities:

- Sparkling wines: Strengthen their position at aperitif time

- White wines: Develop their versatility (aperitif, meals, cooking)

- Rosé wines: Capitalize on their convivial and refreshing image

- Red wines: Explore association with legumes and develop aperitif consumption

Premiumization: a response to quality

Despite the inflationary context, a premiumization trend is emerging. Wines over €20 are progressing (25% of buyers, +3 points), while the €11-20 bracket remains majority (52%). This evolution reveals a qualitative approach to consumption, where consumers prefer to drink less but better.

Evolving purchase criteria:

- Price: 52% (-2 points) – remains predominant but slightly declining

- Region of origin: 48% (+2 points) – gaining importance

- Grape varieties: 25% (-1 point) – relative stability

This hierarchy of criteria underlines the growing importance of origin and terroir in purchase decisions.

🧍♂️🧍♀️ Chapter 3: innovation serving experience

The example of orange wine

Orange wine perfectly illustrates consumers’ appetite for novelty. This “fourth color” of wine, although ancient in its techniques, is conquering the French market with 26% of consumers having already tasted it and 31% of buyers having purchased it.

Consumer profile:

- Predominantly male (55%)

- Young (29% between 26-35 years old, 23% between 18-25 years old)

- Concentrated in Île-de-France (29%)

- Informed enthusiasts (63%)

Orange wine benefits from superior valorization compared to other still wines, with 15% of consumers allocating a budget over €20, compared to 11% for red, 10% for white and 8% for rosé.

The format revolution

Alternative formats are disrupting traditional codes. While Bag-in-Box maintains its position (64% despite -10 points), the emergence of the can format (26%, +13 points) demonstrates adaptation to nomadic lifestyles and individual consumption.

These innovations respond to practical expectations but also to a search for modernity and differentiation.

Experiential wine tourism

Wine tourism makes a remarkable entry into consumption practices, with 34% of French people having visited a wine region specifically for its heritage. The development potential remains considerable: 72% of non-wine tourists declare themselves interested.

Most attractive regions:

- Bordeaux (37%)

- Burgundy (28%)

- Alsace (25%)

- Champagne (18%)

This trend is part of a quest for authenticity and experience, where consumers seek to understand the origin and creation of the products they consume.

Connected wine and digitalization

The digital transformation of the wine sector is accelerating with technological innovations that enrich the consumer experience:

Emerging technologies:

- Augmented reality to visit estates remotely

- Interactive QR codes for traceability

- Mobile applications for food-wine pairings

- Environmental footprint transparency tools

This digitalization responds to a growing demand for transparency and information from consumers.

Ethics and sustainability

Environmental concerns are becoming central to purchasing decisions. Organic wines should represent nearly 20% of the French market by 2025, supported by recognized certifications (AB, HVE).

Sustainable trends:

- Growth of natural wines without chemical inputs

- Attention to packaging and carbon footprint

- Maintaining sensitivity to environmental labels (51% of buyers)

Wine “Cocktailization”

Hybridization between categories opens new perspectives. Wine-based cocktails (spritz, fruit mixes) appeal to a young and diverse audience, responding to demand for beverages that are both gourmet and accessible.

🍸 Chapter 4: the rise of spirits and mixology

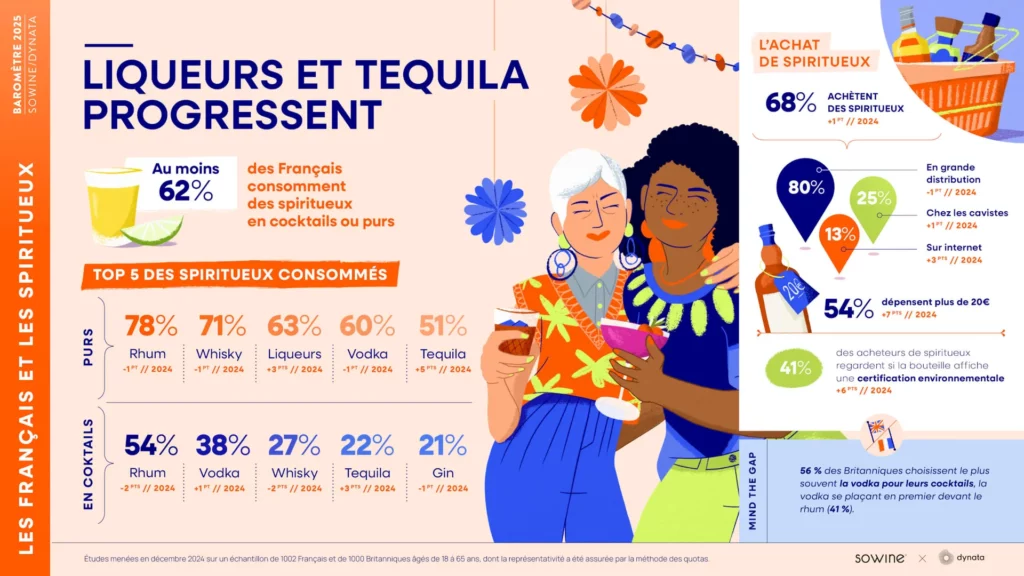

Confirmed growth dynamics

Interest in spirits continues its remarkable progression, reaching 41% in 2025 (+3 points). This growth is accompanied by taste diversification and sophistication of consumption practices.

Hierarchy of spirits consumed neat:

- Rum (78%)

- Whisky (71%)

- Liqueurs (63%, +3 points)

- Vodka (60%)

The most notable progressions concern agave spirits: tequila (51%, +5 points) and mezcal (23%, +6 points), demonstrating openness to less traditional spirits in France.

Mixology: art and practice

Although interest in mixology remains stable (36%), practice reveals significant evolutions. Cocktail preparation remains occasional for 43% of practitioners, but preferences are evolving:

Privileged spirits in cocktails:

- Rum (54%, -2 points)

- Vodka (38%, +1 point)

- Whisky (27%, -2 points)

- Tequila (22%, +3 points) – strongest progression

This evolution reflects the influence of international trends and the taste openness of French consumers.

Premiumization and New Purchase Habits

The spirits market is experiencing marked premiumization. The €21-50 average basket becomes majority (48%, +5 points), while purchases from wine merchants progress (25%, +1 point over one year, +7 points over five years).

Evolving purchase criteria:

- Environmental dimension: 41% consult certifications (+6 points)

- Search for quality and authenticity

- Growing importance of origin and production methods

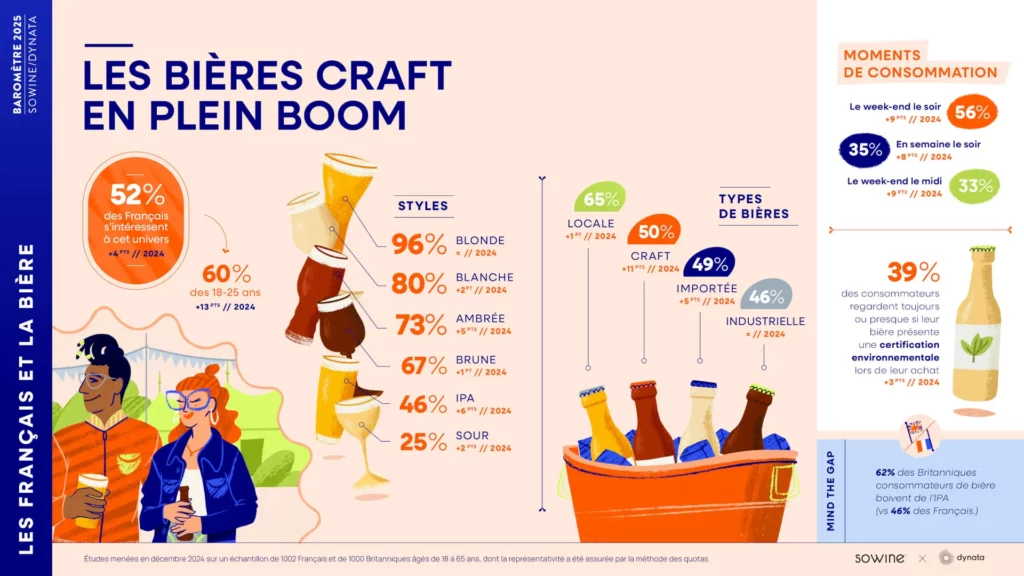

🍺 Chapter 5: the revolution of alternatives through craft beers and No-Low beverages

The explosion of craft beers

Beer is undergoing profound transformation with the emergence of craft beers moving from fourth to second place in preferences. This evolution is accompanied by taste sophistication.

Types of beers progressing:

- Amber beer (+5 points, 73%)

- IPA (+6 points, 46%)

- Local beers (65%)

- Craft beers (50%)

This trend reveals a search for authenticity and proximity, with growing attention to environmental certifications (39% of consumers, +3 points).

No-Low beverages: a fundamental trend?

Consumption of non-alcoholic or low-alcohol beverages (no-low) progresses significantly, reaching 32% (+4 points). This trend is particularly marked among 18-25 year-olds (51%, +11 points).

Main motivations:

- Alcohol consumption reduction (50%)

- Health concerns (40%)

- Taste (35%)

Evolutions by category:

- No-low beer: 61% (down 4 points)

- No-low cocktails: 42% (-6 points)

- No-low wine: 17% (+7 points) – strongest progression

Non-alcoholic wine, despite its progression, faces mixed reception with 45% dissatisfaction. This situation represents both a challenge and an opportunity for producers.

🖥️ Chapter 6: the digital transformation of the sector

E-commerce and new distribution channels

Online wine purchasing stabilizes at 34% (+1 point), with an average basket maintained between €31-50. The site hierarchy evolves with mass retail in the lead (33%, +6 points), followed by wine merchants (30%) and producers (27%).

For spirits, stability is confirmed (39% of online buyers) with a preference for producer sites (32%).

Social media influence

Digital presence diversifies with the emergence of new platforms:

Social media ranking:

- YouTube (84%)

- Facebook (79%)

- Instagram (66%, +5 points)

- LinkedIn (44%, +4 points)

- TikTok (44%, +2 points)

TikTok becomes the preferred network for following wine brands (28%, +4 points), surpassing Instagram (27%). This evolution reveals the growing importance of short video content and authenticity in communication.

Influencer impact

The relationship with influencers is polarizing: 39% attach importance to their advice (+1 point), but 37% turn away from them (+8 points). This dichotomy underlines the importance of authenticity and relevance in influencer partnerships.

Wine-specific data:

- 18% of online buyers have purchased following a social media recommendation

- 62% of frequent buyers (monthly) are influenced by social media

🔮 Chapter 7: future perspectives and recommendations

Long-term trends

Data analysis reveals structural trends that will shape the market in the coming years:

Demographic and generational evolutions:

- Growing appetite of young people for quality wine and spirits

- Search for authenticity and experiences

- Importance of sustainability and ethics

Technological innovations:

- Digitalization of experiences (augmented reality, traceability)

- E-commerce and subscription development

- Personalized recommendations

Strategic recommendations

For wine producers:

- Diversify the offer: Explore new categories (orange wine, alternative formats)

- Develop wine tourism: Create immersive and authentic experiences

- Adopt sustainable practices: Organic certification, carbon footprint reduction

- Strengthen digital presence: Use social media for storytelling

- Target young consumers: Adapt communication codes

For spirits:

- Capitalize on premiumization: Develop high-end ranges

- Invest in mixology: Collaborate with bars and mixologists

- Explore emerging spirits: Tequila, mezcal, artisanal liqueurs

- Develop direct sales: Producer sites and immersive experiences

For beers:

- Focus on craft: Develop local and special beers

- Innovate in styles: IPA, amber, seasonal beers

- Communicate on origin: Valorize terroir and local ingredients

Challenges to overcome and emerging opportunities

The challenges remain timeless for our industry which must ensure rapid adaptation to changing markets and climatic conditions:

- Climate change: Adaptation of viticultural practices and development of new regions

- Regulatory evolution: Anticipation of new environmental standards

- International competition: Differentiation through quality and authenticity

- Taste transformation: Constant monitoring and product innovation

Finding opportunities lies in the actor’s ability to properly identify their consumers’ needs and their purchase criteria:

- Niche markets: Natural wines, local spirits, craft beers

- Premium experiences: Wine tourism, private tastings, subscriptions

- No-low segments: Development of quality non-alcoholic products

- Export: Valorization of French know-how internationally

💭 Conclusion: a tense market revealing opportunities

The French wine and spirits market in 2025 is characterized by a profound transformation of consumption codes. This evolution, far from being a threat, represents a historic opportunity for sector players who will be able to adapt and innovate.

French consumers, more educated and demanding, now favor quality over quantity, authenticity over standardization, and experience over simple consumption. This evolution is accompanied by increased environmental awareness and a search for meaning in purchasing acts.

The companies that will prosper will be those that will be able to:

- Combine tradition and innovation

- Integrate environmental concerns

- Develop authentic experiences

- Adapt their communication to new digital channels

- Intelligently target new generations

The French wine sector, with its exceptional terroirs and centuries-old know-how, has all the assets to succeed in this transformation. The challenge now consists of preserving the essence of our traditions while embracing the innovations that will shape the future of consumption.

This transformation is not an end but a beginning: that of a new era where French wines, spirits and beers will continue to seduce and surprise, by adapting to the expectations of a constantly evolving society.

Vignobles & Compagnie accompanies sector players in this transformation by proposing solutions adapted to contemporary challenges while preserving the excellence and authenticity that make the reputation of French wines and spirits.

Some additional sources and articles:

- Le Figaro : Vins, cocktails, spiritueux : ce que boivent (vraiment) les jeunes en 2025

- SoWine : Les Français et l’œnotourisme, Baromètre SOWINE/Dynata 2025 : les Français et le digital avec Sylvain Dadé

- Vin et Société : L’évolution de la consommation de vin en France – Vin & société

- Verallia : Les tendances émergentes du marché des vins et spiritueux en 2025 – Verallia Design Awards